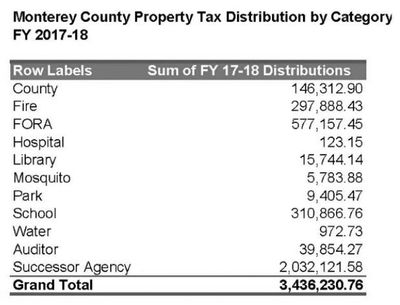

monterey county property tax calculator

The property is first reassessed by staff of the Assessors office. Find Monterey County Property Tax Collections Total and Property Tax Payments Annual.

California Measure Could Spur More Seniors To Sell Homes Easing The State S Housing Crunch House Cost Mortgage Rates Mortgage

Monterey County Property Taxes Range Monterey County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe.

. Tennessee Property Tax Calculator Smartasset Contra Costa County Ca Property Tax Search. American Community Survey 2018 ACS 5-Year Estimates. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and.

Monterey county property tax calculator Wednesday August 31 2022 Edit. County Departments Operations During COVID-19. Monterey County collects on average 051 of a propertys.

Discover Act on services in County of Monterey like Property taxes Parking Traffic Tickets Utility Bills Business Licenses more Online. Home facts updated by county records on Jun 8 2022. To calculate your property tax in Monterey county you take the assessed value of your property minus any exemptions you may be qualified for and multiply it by the tax rate.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Testing Locations and Information. The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025.

1-831-755-5057 - Monterey County Tax Collectors main telephone number. Supplemental assessments were established pursuant to provisions in Senate Bill 813 known as the Hughes-Hart Educational Reform Act of 1983 enacted on. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

Sales Tax Table For Monterey County California Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 849 in Monterey County. You will need your 12-digit ASMT number found on your tax bill to make payments. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of. The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county. The MONTEREY COUNTY ASSOCIATION OF REALTORS in line with our organizations Mission and Vision is committed to making our website accessible to everyone.

When totalled the property tax load all taxpayers shoulder is created. The Supplemental Roll is the accumulation of supplemental assessments made by the Assessor. The median property tax on a 31860000.

Contact Us A-Z Services Jobs News Calendar. Monterey Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly youre unfamiliar that a real estate tax levy. This calculator can only provide you with a rough estimate.

Cost of home ownership. The property tax rate in the county is 078. Choose Option 3 to pay taxes.

At this time we. With a total estimated taxable market worth recorded a citys budget office can now calculate required tax rates. 30 year fixed 35 interest.

How Cool Jeffers Fairytale Cottage Unusual Homes

Monthly Payment Option Available For Current Year Tax Bills County Of San Luis Obispo

Additional Property Tax Info Monterey County Ca

Seventeenth Century French Warship Art Print Morel Fatio Art Com

How Much Is Property Tax In California Caris Property Management

How To Calculate Property Tax And How To Estimate Property Taxes

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

12321 Fort King Hwy Thonotosassa Fl 33592 Mls T3154789 Zillow Florida Mansion Mansions Lakefront