child tax credit november 2021 direct deposit

Families claiming the CTC will receive up to 3000 per qualifying child between the ages of 6 and 17 or up to 3600 per qualifying child under age 6 at the end of 2021. For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for.

Childctc The Child Tax Credit The White House

The remainder will come when parents file.

. Simple or complex always free. If Congress doesnt extend it the Child Tax Credit would revert to its pre-2021 level or 2000 for each child under the age of 17. Single parents earning up to 75000 a year and couples.

The IRS is distributing half of the credit as an advance on 2021 taxes in six monthly installments worth 250 to 300 per child. The Treasury Department said families with roughly 61 million eligible children received more than 15 billion in the fifth batch. IRS issues November Child Tax Credit payments.

Single parents earning up to 75000 a year and couples. Thats less generous than the enhanced. This is a good idea anyway since failing to file.

However families can still opt out for the final two checks by un-enrolling via the Child Tax Credit Update Portal by these dates. November 1 for the November 15 payment. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

For 2021 eligible parents or guardians can receive up to 3600 for each child. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29.

The deadline for the next payment was November 1. Check out The Ascents best tax software for 2022 Last year American families were thrown a lifeline in the form of the boosted Child Tax CreditIn 2021 the credit was worth up to 3600. Another phaseout would drive the child tax credit below 2000 for each child and thats when the modified adjusted gross income is above 400000 for married couples.

File a federal return to claim your child tax credit. The tax credit provides families with 3600 total per child under age 6 and 3000 total per child ages 6 to 17. So parents of a child under six receive 300 per month and parents of a child six or.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. The last payment for 2021 is scheduled for Dec. For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

Child tax credit deposit date november 2021 Monday March 14 2022 Edit. 3 January - England and Northern Ireland only. Families will see the.

The tax credit provides families with 3600 total per child under age 6 and 3000 total per child ages 6 to 17.

Childctc The Child Tax Credit The White House

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Ontario Child Benefit 2022 Payment Dates Amounts Eligibility

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Child Tax Credit Payments Started Hitting Bank Accounts Today Here S What You Need To Know

Canada Revenue Agency Canrevagency Twitter

Canada Revenue Agency Canrevagency Twitter

Child Tax Credit Payments Started Hitting Bank Accounts Today Here S What You Need To Know

Child Tax Credit Payments Started Hitting Bank Accounts Today Here S What You Need To Know

Ontario Works Payment Dates And Benefits Application 2022 Savvynewcanadians

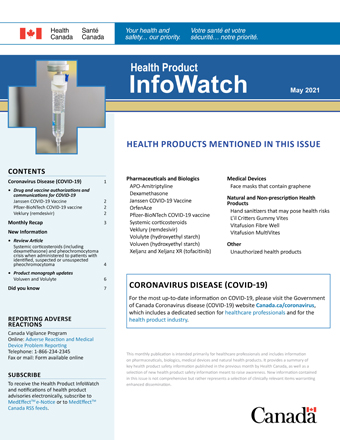

Health Product Infowatch May 2021 Canada Ca

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time